The launch of the first direct freight train service from China to Europe via the Trans-Caspian International Transport Route (TITR), commonly known as the “Middle Corridor”, represents a significant development in global supply chain infrastructure. This milestone, marked by trains departing from Beijing and Chinese cities Chongqing and Chengdu in June and July 2025, signals the emergence of a viable alternative to traditional Northern Corridor routes through Russia. Türkiye is expected to have a crucial geopolitical role in the Middle Corridor because of its unique strategic position at the crossroads of Europe, Asia and Middle East, offering a credible, politically safer alternative for east-west trade.

A New Transportation Route

The inaugural service commenced on 30 June 2025, with the first train carrying 104 containers of automotive parts and mechanical equipment valued at over US$2 million departing from Beijing’s Fangshan district. Subsequently, two freight trains departed China on 9 July 2024 for Türkiye and then to Europe (Poland and Hungary) through Istanbul, marking the establishment of regular service connecting Chongqing and Chengdu with Europe via the Middle Corridor.

The multimodal transport chain spans over 8,000 kilometres, connecting Beijing to European destinations via Kazakhstan, the Caspian Sea, Azerbaijan, Georgia, and Türkiye, with transit time reduced to 15 days. Each train carries approximately 2,000 metric tons of cargo.

The service operates under an agreement between Turkish firm Pasifik Eurasia and China’s State Railway, signed during the Global Transport Corridors Forum held in Istanbul between 27 and 29 June 2024. This agreement reinforces Türkiye’s strategic position in the Europe-Asia logistics network.

Strategic Significance for the Turkish Market

Türkiye has invested nearly US$300 billion in transport and communication infrastructure over the past two decades, expanding its railway network by 3,000 kilometres to reach 13,919 kilometres, including 2,251 kilometres of high-speed rail. The national railway network ensures uninterrupted connectivity for trains reaching Europe.

The Ministry of Infrastructure and Transportation characterised the launch as representing a “new era” in the East-West logistics chain, with the trains serving as “physical manifestations of Türkiye’s vision for logistics on the Middle Corridor.” The initiative positions Türkiye as a geostrategic hub providing alternative routes for regional and global trade resilience, even during crises. The Turkish government aims to facilitate 1,000 trains annually through this corridor, significantly enhancing the country’s logistics capabilities and regional influence.

Geopolitical Advantages and Market Context

The Middle Corridor provides a resilient alternative to overburdened or geopolitically sensitive routes, particularly the Northern Corridor through Russia. This diversification addresses supply chain vulnerabilities exposed during the coronavirus pandemic and exacerbated by the Russia-Ukraine conflict.

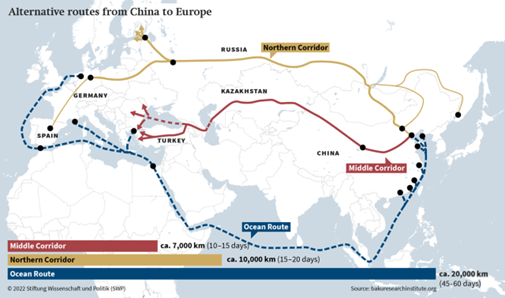

The Middle Corridor, at approximately 7,000 kilometres, is 2,000 kilometres shorter than the Northern Corridor (10,000 kilometres) and significantly faster than ocean routes (20,000 kilometres). Transit times range from 10-15 days compared to 15-20 days for the Northern Corridor and 45-60 days for ocean transport.

Container traffic through the Middle Corridor increased by 45% during the first ten months of 2022 compared to the previous year, with transit cargo through Azerbaijan increasing by approximately 65%. The corridor’s annual capacity is indicated as 10 million tons, including 200,000 containers.

Legal and Regulatory Framework

The Middle Corridor’s institutional foundation was established in Astana in 2013 by the Coordination Committee of the Governments of Azerbaijan, Georgia, and Kazakhstan for the Development of the Trans-Caspian International Transport Route. This trilateral framework created the initial governance structure for coordinating cross-border transport operations and establishing common standards across participating jurisdictions.

The corridor operates under a comprehensive network of bilateral and multilateral international agreements designed to improve physical and digital infrastructure whilst optimising operational processes. These agreements primarily involve Azerbaijan, Türkiye, Kazakhstan, and Georgia and were executed throughout 2022 and April 2023, reflecting the accelerated diplomatic engagement following geopolitical developments in Eastern Europe.

The Middle Corridor also forms part of China’s Belt and Road Initiative (BRI) framework, specifically constituting the China-Central Asia-West Asia Economic Corridor (CCAWEC). All four main corridor countries—Azerbaijan, Türkiye, Georgia, and Kazakhstan—have signed memoranda on developing mutually beneficial economic relations and deepening existing cooperation with China under the BRI framework.

This integration provides access to substantial financial resources through the Asian Infrastructure and Investment Bank (AIIB), established in May 2016 with initial authorised capital of US$100 billion. Azerbaijan is a founding member of AIIB with total subscriptions of US$254.1 million, whilst the bank has provided significant financing for regional infrastructure projects, including a US$600 million long-term loan for the Trans-Anatolian Natural Gas Pipeline (TANAP) in December 2016.

The EU currently supports international infrastructure projects through the Global Gateway Strategy, announced in 2021, which aims to mobilise up to €300 billion in investments between 2021 and 2027.

Investment Requirements and Challenges

The European Bank for Reconstruction and Development (EBRD) estimates that approximately US$3.5 billion must be allocated for infrastructure construction to enable the Middle Corridor to effectively regulate transcontinental cargo transportation.

Current limitations that need to be eliminated in order to make this route more efficient include customs coordination across multiple jurisdictions, insufficient technical equipment at seaports, shortage of large-scale ferries in the Caspian and Black Seas, incomplete electrification of rail networks between Georgia and Türkiye, and limited port capacity.

Implications for the Turkish Economy and Market

The Middle Corridor positions Türkiye as a critical geostrategic hub providing alternative routes for regional and global trade resilience, even during crises. This strategic positioning transforms Türkiye from a peripheral transit point into a central logistics nexus connecting Europe and Asia, fundamentally enhancing the country’s economic leverage in international trade negotiations and partnerships.

The Turkish government’s target of facilitating 1,000 trains annually through the Middle Corridor represents significant growth potential for the domestic logistics sector. Each train carries approximately 2,000 metric tons of cargo, indicating substantial handling, processing, and value-added service opportunities for Turkish logistics companies. The regular service connecting Chinese cities with Europe via Turkish territory creates sustained demand for logistics services, warehousing, customs processing, and related professional services.

Türkiye’s strategic focus on developing seaports such as Filyos (Black Sea), Çandarlı (Aegean Sea), and Mersin (Mediterranean Sea) directly supports increased load capacity for the Middle Corridor. These port developments create opportunities for:

- Maritime service providers and shipping companies;

- Port operations and cargo handling services;

- Customs and freight forwarding services; and

- Storage and distribution facilities.

The Middle Corridor provides Turkish manufacturers with enhanced access to Central Asian and Far Eastern markets, circumventing Iran and Russia, both of which are under sanctions. This alternative route enables Turkish exporters to reduce dependency on traditional transit routes; access new markets in Central Asia and China; benefit from shorter transit times compared to ocean routes; and leverage competitive positioning against European competitors.

The corridor’s development creates substantial opportunities for Turkish financial institutions in, the trade finance and letters of credit for increased cargo volumes, foreign exchange services for multi-currency transactions, insurance services for cargo and transit operation, investment banking services for infrastructure projects

With petroleum products comprising 34.8% of the most transported cargoes through the corridor, Turkish energy companies and commodity traders benefit from, increased energy transit volumes, enhanced trading opportunities in regional energy markets, strategic positioning in Caspian energy exports and diversified energy supply routes.

The Middle Corridor facilitates deeper economic integration with Central Asian economies, particularly through the Organisation of Turkic States framework. This integration creates opportunities for joint ventures with Central Asian companies, cross-border investment flows and enhanced bilateral trade relationships.

The Middle Corridor’s emergence represents a transformative opportunity for the Turkish economy, positioning the country as an indispensable link in the evolving Eurasian trade architecture whilst creating substantial opportunities across multiple economic sectors.

Share

Related persons

You can contact us for detailed information.

Legal Information

This briefing is for information purposes; it is not legal advice. If you have questions, please call us. All rights reserved.

You May Be Interested In

19 February 2026

Turkish Competition Law Newsletter – 2026 Winter Issue

Welcome to the 2026 Winter edition of the Paksoy Turkish Competition Law Newsletter series.

17 February 2026

The Constitutional Court Confirmed the Competition Authority’s Power to Conduct On-Site Inspections

The Constitutional Court decision dated 6 November 2025 and numbered E. 2023/174, K. 2025/224 (“Constitutional Court Decision”), published…

17 February 2026

Türkiye’s Digital Copyright Bill under parliamentary review: key takeaways for digital platforms and rightsholders

On 10 December 2025, the Digital Copyright Bill (“Bill”) was submitted to the Presidency of the Turkish Parliament.

11 February 2026

New Merger Control Regulation From The Turkish Competition Board: Increased Turnover Thresholds And Special Regulation For Technology Undertakings

With the Communiqué Amending the Communiqué on Mergers and Acquisitions Requiring the Approval of the Competition Board (Communiqué No:…

6 February 2026

Legal Developments Regarding the Cultivation of Cannabis and Cannabis Products

The Regulation on Cannabis Cultivation and Control (“Regulation on Cannabis Cultivation”) and the Regulation on Products Derived from…

30 January 2026

Recent developments in Turkish data protection law

The end of 2025 and the beginning of 2026 have seen notable developments in Turkish data protection law, particularly regarding personal…